Responsible investment

We aim to be responsible investors of our members’ assets and believe that investment decisions should reflect environmental, social and governance (ESG) considerations

Our investment approach

The People’s Pension has a logical, straightforward approach to investment. Our approach allows us to balance the complexity of managing risk and generating investment performance, with a simple and effective presentation of facts and choices to members.

Most members are invested in our default option – the ‘balanced’ investment profile. We’ve carefully thought through this investment profile to ensure it delivers an appropriate pension savings solution for members at different stages of their careers. Read more about our default option and investment choices for members.

The Trustee of The People’s Pension has a duty to our members to make decisions that are most likely to improve returns. They’re responsible for setting the investment strategy and governing the Scheme’s investment in line with its ‘Statement of Investment Principles’ (SIP).

Our ‘Investment implementation statement’ shows how the principles in the SIP have been applied, along with a summary of voting activity undertaken by the Scheme’s fund managers on the Trustee’s behalf.

The day-to-day management of the investments has been delegated by the Trustee to professional investment managers Amundi Asset Management, Invesco Asset Management Limited, and State Street Global Advisors Limited (SSGA). All 3 are regulated by the Financial Conduct Authority (FCA) in the United Kingdom and manage our investments within the restrictions set out in the investment management agreement.

Responsible investment and ESG issues

Responsible investment is an investment approach that considers how the companies in which we invest our members’ money manage environmental, social and governance (ESG) factors in their business operations. How a company treats the environment, people, and how it is led and managed can have both financial and non-financial impacts on members, as well as cause long-term damage to the health of the planet and financial systems.

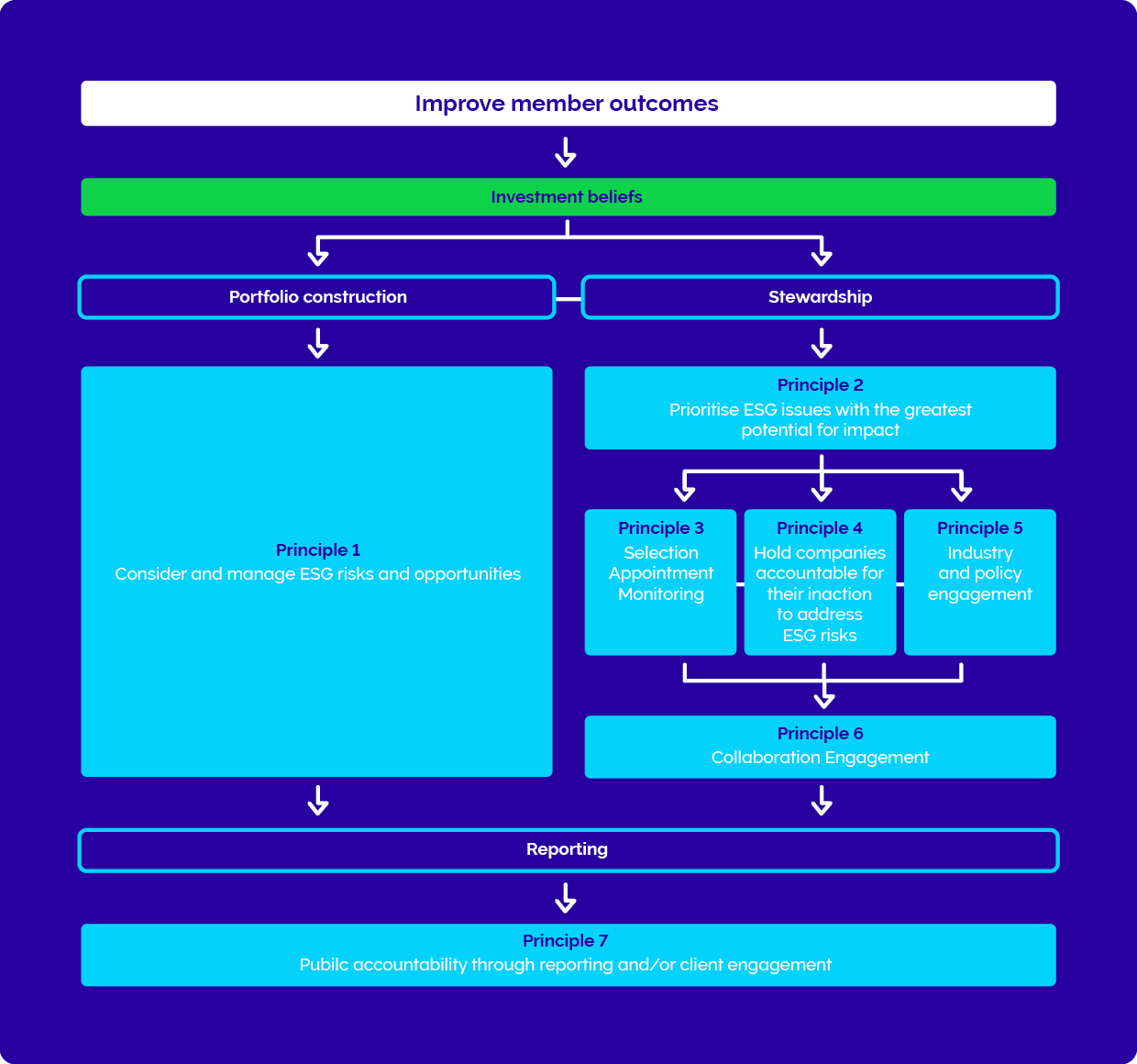

The People’s Pension has developed a strategic framework to guide its responsible investment approach. It consists of a set of principles divided into 3 pillars:

- Portfolio construction – how we invest the portfolio

- Stewardship – how we work with companies and other stakeholders on ESG issues

- Reporting – how we publicly report and engage on what we are doing

Our ‘Responsible investment policy’

Our ‘Responsible investment policy’ sets out how we will use our scale and influence as one of the largest UK asset owners to drive change on responsible investment issues.

For a more accessible version, see our ‘Responsible investment policy – member summary’ .

It includes our expectations around our asset managers stewardship priorities on 3 issues: climate change, nature and human rights.

It outlines expectations for our asset managers which include having a commitment to net zero and adequate stewardship resourcing.

Our asset managers are expected to help us achieve our emissions reduction targets of:

- net zero greenhouse gas (GHG) emissions by 2050

- reducing the GHG emission intensity from our growth assets—which are mostly shares in multinational corporations—by half by the year 2030

- reducing the emissions intensity of the developed equity (ie, company shares in developed economies like the US or UK) portion of our investment assets’ GHG by 30% by 2025.

Asset Owner Statement on Climate Stewardship

In alignment with its Responsible Investment Policy, The People’s Pension has taken the lead on the creation of an ‘Asset Owner Statement on Climate Stewardship’ in collaboration with other like-minded investors.

It aims to encourage dialogue between asset owners (like The People’s Pension) and asset managers, ensuring they effectively represent the long-term interests of its members while addressing climate-related risks and opportunities..

Member feedback is important to us

We ask our members, ‘which issues are most important to you for The People’s Pension to take into consideration when making decisions about where to invest your money?’. This helps to influence the order and priority of our research.

So far, climate change has come out on top…

To date, those who’ve completed our online responsible investment survey have told us:

- Climate change (80%)

- Sustainable land use (39%)

- Controversial weapons (37%)

- Packaging and waste (32%)

- Tax avoidance (29%)

The People’s Pension online responsible investment survey results so far as at 8 March 2024 (survey is currently ongoing since July 2019).

Climate change is a priority

Our approach to responsible investment has recently seen us move £15bn into climate-aware strategies as part of our net zero commitment, putting our investment beliefs into practice.

70% of our main investment fund is in climate-aware funds, which immediately reduces its carbon intensity by 30%. The climate-aware funds will further reduce emissions intensity by 7% each year, to be aligned with reaching net zero by 2050.

The main aim of the change is to manage the long-term risks posed to your pension pot by climate change. This move was designed to deliver even better investment returns for you, and we hope it provides you with confidence that your savings are working towards a net zero target.

Climate change

Moving towards net zero investments.

Net zero voting guidelines

When you save into our pension, we invest your money in companies around the world with the aim of increasing the long-term value of your savings. Investing in these companies enables us to engage with them and vote on their board decisions that influence how they operate.

To make sure our asset managers are working in your best interests, we’ve set them clear guidelines on their approach to voting and engaging with these companies that encourage changes that will reduce their impact on the environment, nature, and human rights. Specifically, this includes expecting our asset managers to vote against company directors when a company fails to meet expectations on climate change and deforestation.

Investing your pension

We invest your money to give it a better chance of being worth more in the long run.

Our investment funds

Read about our investment funds and compare their past performances.