Over 80 years

Providing benefits

1 in 5 workers

In UK save with us

Over £30bn

Assets we manage

1 in 5 UK workers applies to those aged 22 and over with a workplace pension. All figures correct as of end March 2025

Charges

Every pension company charges you for looking after your money. This is usually called an annual management charge (AMC). Even a small difference between these percentages could mean you’ll be thousands of pounds better or worse off in retirement, which can impact the lifestyle you want to lead.

Annual management charge calculator

For all the details visit our member AMC webpage. Your personal charges and rebate may differ slightly. Log in to your account to check.

No charges to transfer your pensions

Some providers charge a fee to transfer your pension pot to them or to another provider. We believe transferring shouldn’t come at a cost.

Charge to transfer

£0.00

To transfer other pots in to us

Pension consolidation calculator

Find out whether combining your other pensions with us could grow your savings using our pension consolidation calculator.

By visualising potential growth and savings, you can make an informed decision around where to save your money.

Investment performance

Pensions are invested in stocks, shares and bonds all around the world, so the value of your pot can go up and down. It’s hard to predict the future, but looking at how your provider’s investments have grown over time is a smart move.

How we’ve grown over time

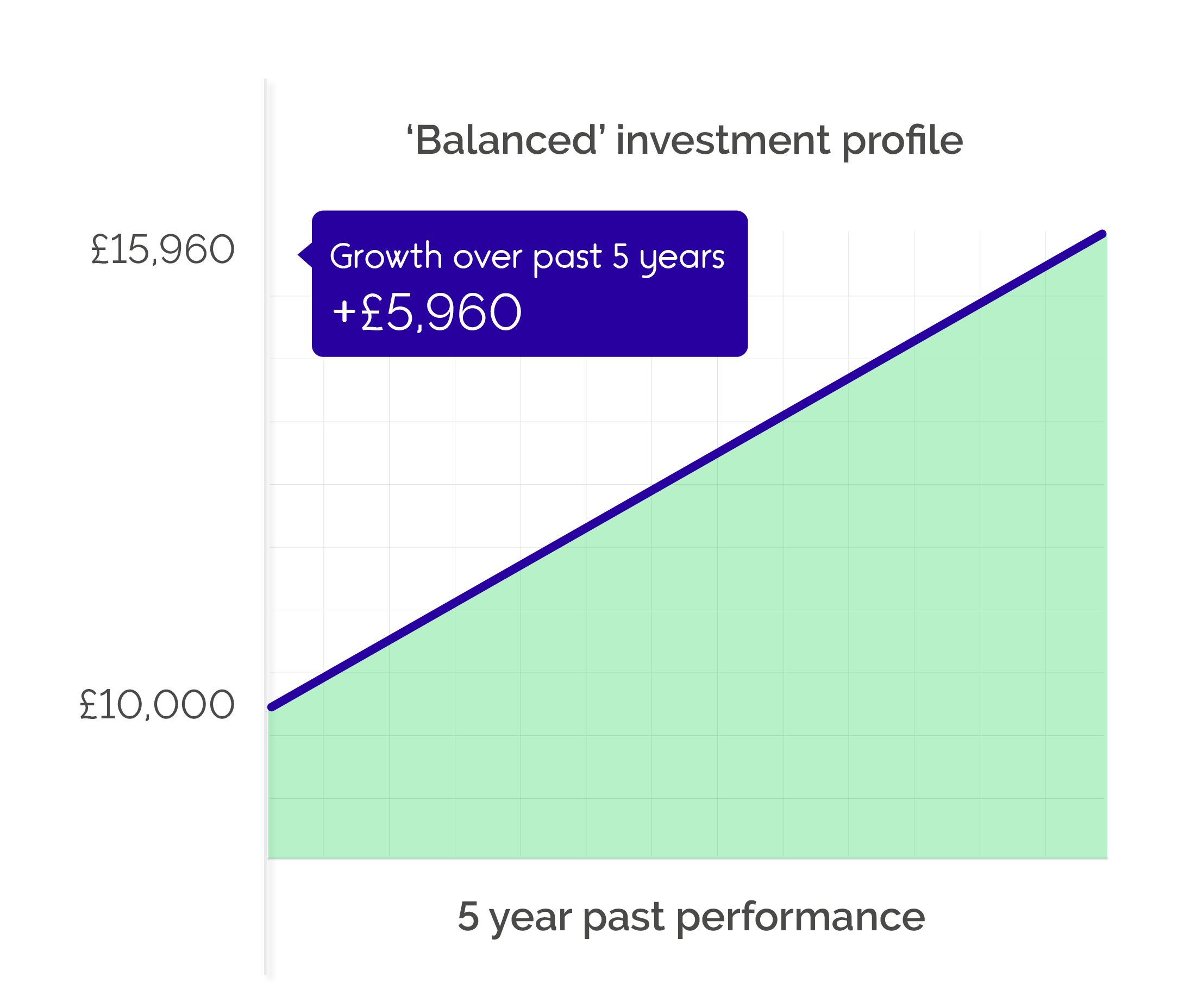

If you had invested £10,000 in the ‘balanced’ investment profile 5 years ago, your pension would now be worth £15,960 (that’s 59.6% growth over 5 years).

We add everyone to our ‘balanced’ investment profile – unless you choose otherwise.

It aims to provide a balance between risk and reward with the goal of targeting long-term investment growth.

There are other investment options if you’d prefer a different approach.

‘Balanced’ investment profile

5 year past performance

*The calculation used applies to members with all their pension pot in the balanced investment profile and invested in the Global Investments (up to 85% shares) Fund.

15 years before retirement: helping to protect your money

*The example in the graph above is for a member in our balanced investment profile.

As you get closer to retirement, we gradually move your money into our Pre-Retirement Fund which aims to offer greater protection.

The Pre-Retirement Fund is lower risk, aims for steady growth, and generally means your money is less exposed to volatility in the stock market.

This process starts 15 years before your selected retirement age – the default age is 68 for men and 65 for women.

‘Balanced’ investment profile

This profile is made up of two funds: Global Investments (up to 85% shares) Fund and Pre-Retirement Fund.

Performance in detail: Global investments (up to 85% shares) Fund

The Global Investments Fund aims for moderate growth over the long term, balanced with an investment in lower-risk assets intended to provide some security.

| Past performance before charges | Over 5 years | Over 3 years | Over 1 year |

|---|---|---|---|

| Value on 31/03/2025 if you had invested £10,000 | £15,960 | £11,409 | £10,634 |

| Performance to 31/03/2025 | 59.6% | 14.1% | 6.3% |

Performance in detail: Pre-Retirement Fund

If you’re invested in the Balanced investment profile and within 15 years of your selected retirement age, your contributions will be moved into the Pre-Retirement Fund, to prevent rapid swings in the value of your pension savings as you approach retirement while targeting moderate investment growth.

| Past performance before charges | Over 5 years | Over 3 years | Over 1 year |

|---|---|---|---|

| Value on 31/03/2025 if you had invested £10,000 | £11,299 | £10,503 | £10,462 |

| Performance to 31/03/2025 | 13.0% | 5.0% | 4.6% |

How we calculate fund performance

We calculate fund performance by considering various factors, including market movements and the performance of underlying investments.

Source FE Fund Info.

Service and satisfaction

Charges and performance will have the biggest impact on your pot at retirement. But it’s important you get the right support when you need it, from a real person over the phone for example.

You can count on us

We know speaking with a real person is what matters to many when making financial decisions. Our call centre available for you Monday to Friday 8.30am to 6pm. Call us: 0300 2000 555.

100% emails

Answered in 3 working days

60 seconds

Before we answer your call

86%

Customer satisfaction score

*All figures correct as of end March 2025

Trusted by industry and customers alike

Members at the heart of everything we do

Because we don’t have shareholders, we’re free to reinvest all the profits we make to improve our service to you – we call this profit for people.

Our best price guarantee is unique in the market. If a member has an existing pension and opens a new one, all their savings will be charged at the lowest rate available to them.

Find out more about what makes us different.

Combine my pensions

Combine your pots, log in or register and we’ll guide you through the process.

Comparing charges

Our blog covers different types of charges and how to compare us against others.

Compare our investments

Use our fund factsheets to compare our investment performance with others.