Pension contributions

Payments made into a pension are called contributions. With a workplace pension, like The People’s Pension, contributions normally come from 3 sources: the employee, the employer and the government. As an employee, you can always increase your workplace pension contributions if you want to.

How do workplace pension contributions work?

Payments made into a pension are called contributions. When an employer automatically enrols an employee into a pension (like The People’s Pension), by law there are set minimum contribution levels.

These contributions are completely separate from the State Pension which, at £11,973 a year or £230.25 per week currently (based on someone reaching State Pension age on or after 6 April 2016 with 35 qualifying years on their National Insurance record), is likely to need topping up for most to enjoy a more comfortable retirement.

If you stop your contributions, your employer may also stop paying in too

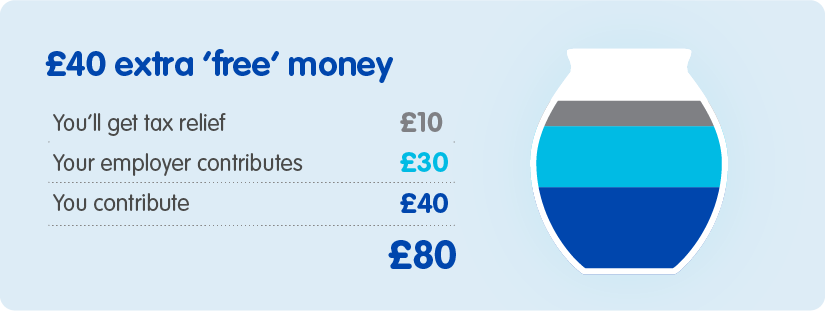

The money you put into your pension pot is topped up by your employer and the government – it includes extra ‘free’ money and is a great way to add to your retirement savings!

Benefits of paying into your pension

- Your workplace pension gives you your own pension that belongs to you – even if you leave your job in the future, it’s yours to keep.

- Each pay period when you pay into it, your employer usually does too and the government lets you hold on to some of your tax to help you build a bigger pot. That’s free ‘extra’ money, meaning more saved towards a more comfortable retirement. Here’s an example1 if you were paying in contributions of £40 per month:

1 The example in the table above shows what happens when contributions are made after tax, and tax relief is claimed for you. Higher rate and additional taxpayers may need to claim further tax relief through their tax returns. The calculation will differ where contributions are made before tax has been taken and tax relief is received automatically. Find out more about tax relief

- Your workplace pension pot is completely separate from the State Pension, and a good way to top up your retirement income.

- The return on your pension savings is likely to be better than from any savings in your bank account. So it’s wise to start saving now to give your money a better chance to grow!

- If you stop your contributions your employer may stop paying in too. So, don’t lose out.

Check what’s in your pension pot

You’ll receive an annual statement in your account showing the value that you hold in The People’s Pension.

But you can check, any time, how much is in your pot by logging in to your account, online or through the app. This will help you keep track of how your investments are doing and give you an idea how much you might have when you retire.

Log into your online account More about The People’s Pension appPay more into your workplace pension

The more you pay in the more tax relief you may receive, so you could have a larger pot for later life. Plus:

- your pension belongs to you – even if you leave your job in the future, it’s your money for life

- the return on your pension savings is likely to be better than from any savings in your bank account

- once you’ve saved over £3,000, you’ll benefit from the rebate on our management charge

- your pension pot is completely separate from the State Pension.

Check how much you need to save for retirement

Did you know? Research from MoneyHelper shows that the maximum State Pension is far below what most people hope to retire on. The State Pension is currently around £230.252 a week – could you manage on that alone?

- Use our retirement planner to work out if you’re on track to live the retirement you want. It shows you how much money you may need and could have in retirement. Find the planner in your account.

- Our life expectancy calculator can give you an idea of how long your pension savings will need to last.

2 The State Pension amount of £230.25 a week is based on someone reaching State Pension age on or after 6 April 2016 with 35 qualifying years on their National Insurance record. Find out more about different types of pension

2 The State Pension amount of £230.25 a week is based on someone reaching State Pension age on or after 6 April 2016 with 35 qualifying years on their National Insurance record. Find out more about different types of pension

How to pay more into your pension pot with us

Regularly add extra money to your pension savings

Small increases in money going into your pension pot can lead to big improvements later in life. If you can afford to, you should think about saving more.

The easiest way to save more is directly from your pay packet. Talk to your employer to see if they can set up the extra payments on your behalf. You never know, your employer may top up their contributions too! Tax relief will be added to your pot in the same way it is now.

Or, you can pay more by Direct Debit

If you change jobs, you can continue saving with us. We’ll claim tax relief at the basic rate on your behalf and add it to your pot. If you’re a higher rate taxpayer you can claim the rest in your tax return.

There are 2 forms to fill in and return to us – we’ll then be in touch to confirm we’ve set up your Direct Debit:

Remember – you can always reduce the amount you pay if things change and you don’t have enough spare cash each month.

Add a one-off payment into your pension

Maybe you’ve received a work bonus or an inheritance. You have the option to add to your pension pot by making one-off contributions as and when you have any spare money.

You can do this through your online banking (sometimes known as BACS). We’ll claim tax relief at the basic rate of 20% on your behalf and add it to your pension pot. If you’re a higher rate taxpayer you can claim the rest in your tax return.

There’s 1 form to fill in and return to us – we’ll then be in touch with more information on how you can send us your personal contributions by BACS.

Download the personal pension contributions form to get started.

Please note – maximum pension contributions

Under HM Revenue & Customs (HMRC) rules there’s a limit on the total amount you can save each tax year into all registered pension schemes and the tax relief you receive on your contributions. The maximum is 100% of your relevant UK earnings (up to the annual allowance) or £3,600 before tax, whichever is higher.

The annual allowance limit for the current tax year is £60,000. This limit includes all your contributions, tax relief and employer contributions across all your pension arrangements. If you go over this limit, this will result in a tax charge, known as the annual allowance charge. In some cases, you can carry forward any unused annual allowance from the previous 3 tax years.

Discover more about tax relief