How your investment changes as you approach retirement

Investment changes approaching retirement

If you’re trying to decide which investment option will suit you best, it’s important to know that the glidepath (ie, the automatic switching of your investments) only applies to our 3 investment profiles.

If you choose your own investment funds, your money won’t automatically move into lower-risk investments as you approach retirement. That means you’ll need to make sure you regularly review the funds you’ve selected (and your attitude to investment risk) as you near retirement.

Three ready-made investment profiles

Each of our investment profiles automatically moves your money into lower-risk investments as you get closer to retirement.

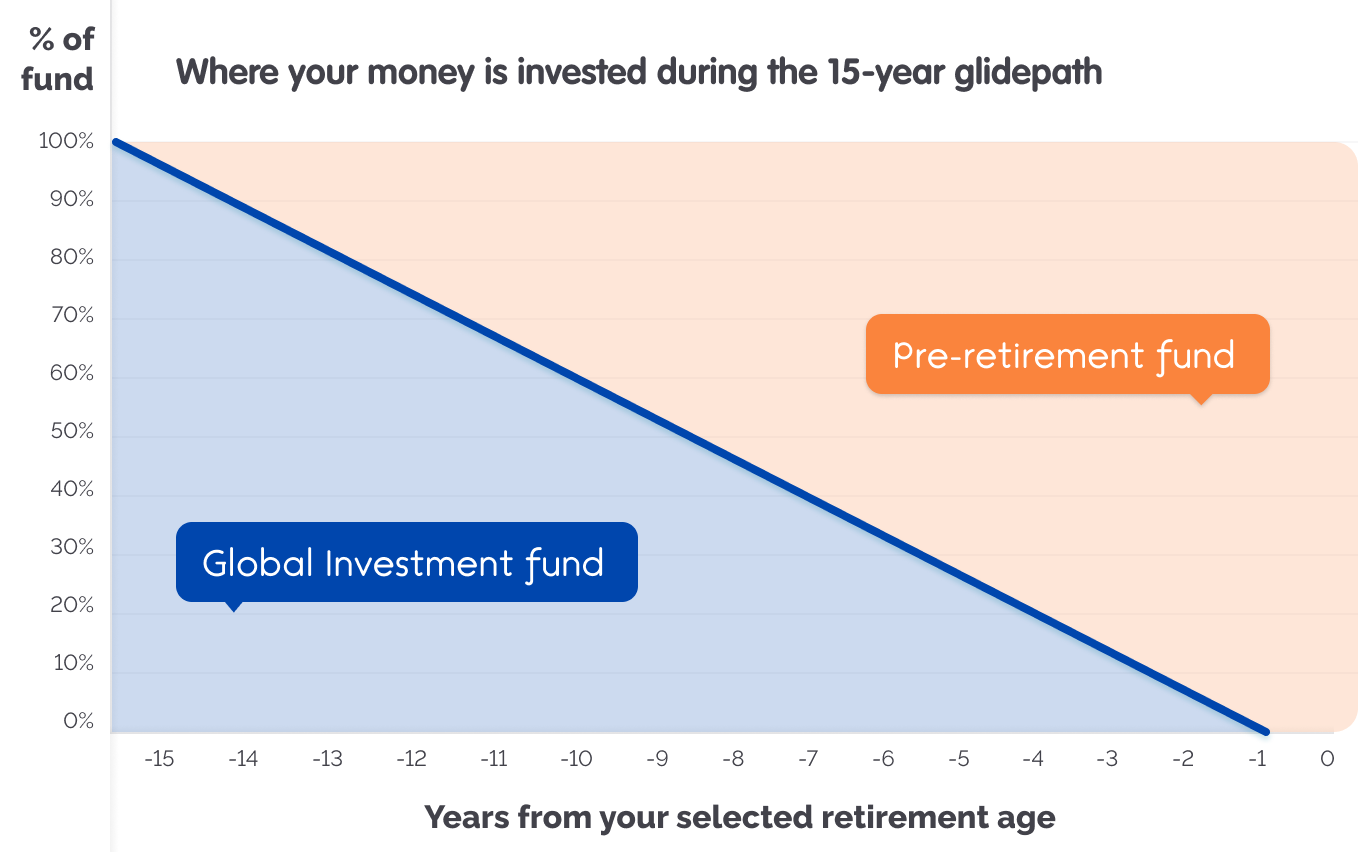

We call this a 15-year glidepath because it normally begins 15 years before your selected retirement age.

Our 15-year glidepath is designed to safeguard your pension savings as you approach retirement.

How the glidepath works

Each of our investment profiles gradually and automatically moves your money into the lower-risk Pre-Retirement Fund as you get closer to retirement. This means your savings are less likely to suffer a large fall in value just when you want to use them.

The glidepath should result in a more predictable return, but could also mean that your pension pot grows less.

The glidepath normally begins 15 years before a member’s selected retirement age (SRA). So, if someone plans to retire at 65, we’ll start switching their investments when they’re 50.

How we move pension savings on the glidepath

As you approach retirement, we’ll gradually move your pension savings from one fund to the other on the following basis:

| Years from SRA | Global Investments Fund | Pre-Retirement Fund |

|---|---|---|

| -15 | 93.75% | 6.25% |

| -14 | 87.50% | 12.50% |

| -13 | 81.25% | 18.75% |

| -12 | 75% | 25% |

| -11 | 68.75% | 31.25% |

| -10 | 62.50% | 37.50% |

| -9 | 56.25% | 43.75% |

| -8 | 50% | 50% |

| Years from SRA | Global Investments Fund | Pre-Retirement Fund |

|---|---|---|

| -7 | 43.75% | 56.25% |

| -6 | 37.50% | 62.50% |

| -5 | 31.25% | 68.75% |

| -4 | 25% | 75% |

| -3 | 16.67% | 83.33% |

| -2 | 8.34% | 91.66% |

| -1 | 0.00% | 100% |

| 0 | 0.00% | 100% |

Self-select investment option

If you’ve chosen to self-select your own funds, unlike our 3 investment profiles, your money won’t automatically move into lower-risk investments as you approach retirement.

That means you’ll need to make sure you regularly review the funds you’ve selected (and your attitude towards investment risk) as you near retirement.

Your retirement age

We will use our default (your State Pension age) or an age you select. You can find out your State Pension age on gov.uk

In line with the government’s changes to the minimum pension age, the earliest date you can take your benefits is:

- from age 55 if you joined the scheme on or prior to 3 November 2021,

- or from age 57 if you joined the scheme from 4 November 2021.

Learn more

Investment funds

Learn more about our range of investment funds.

Responsible investment

Learn how we invest your money responsibly.