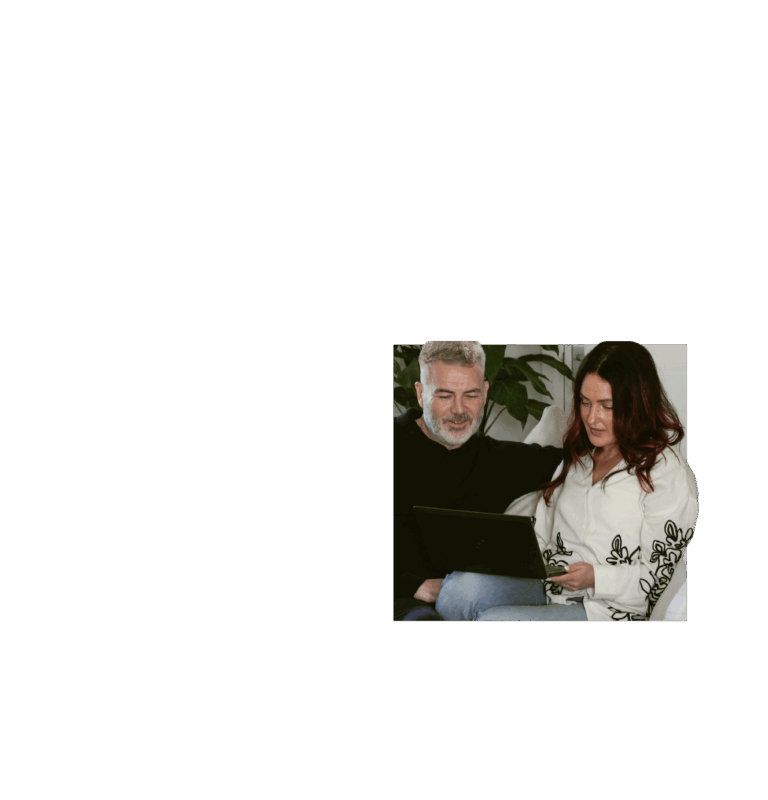

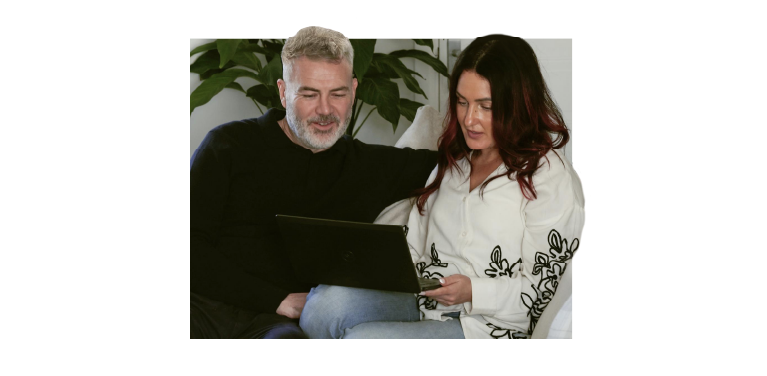

Invest in your future

When you join People’s Pension, your money is automatically placed in our ‘balanced’ investment profile, unless you tell us otherwise.

The ‘balanced’ profile is designed to be appropriate for most of our members’ needs. It aims to generate long-term growth and automatically reduces investment risk as retirement approaches.

If you’d like to explore our other fund options to see if they are right for you, you can easily switch, track performance, or use our pension investment calculator by logging in to your account or app.

Understanding pension investments

When you save with us, your money isn’t just sitting in a bank account — it’s invested in funds made up of a broad mix of assets.

We do this to help your savings:

Grow over the long term

Beat or keep pace with inflation

Smooth out investment ups and downs by spreading risk

How do pension investments work?

- You and usually your employer contribute into your pension.

- Your money is invested in a pension fund made up of financial assets like shares, bonds, property, or infrastructure. These assets are chosen to help your savings grow or keep up with inflation.

- To reduce risk, your money is spread across a range of investments and global markets. This is called diversification, and it helps protect your pension from the ups and downs of any single investment.

- You can choose from a range of investment funds or profiles depending on your goals, tolerance to risk and how close you are to retirement.

What are pension investment funds?

Pension investment funds are professionally managed investment vehicles designed to help grow your savings. Different funds offer different levels of risk and return depending on your preferences and investment goals. You can choose between funds by logging in to your account or app.

How and where we invest your money

Whenever you or your employer make a contribution, you’ll buy what’s called a unit in one or more of our investment funds. Each unit is an equal share of the fund. The price of a unit changes daily and goes up and down based on market performance, but over the long-term, the aim is to grow their value and help you save more for retirement.

Pension investment options

If you haven’t selected where to invest your money, you can leave it in the ‘balanced’ investment profile, choose one of our two other profiles – ‘cautious’ or ‘adventurous’ – or a combination of our eight self-select funds*.

*Please note that if you select the Shariah Fund, you’ll have to invest all of your pension savings with us in this fund.

Investment profiles

Save effortlessly with our three profiles that automatically manage your investments.

Investment funds

Choose where your money is invested – from one or a combination of our funds.

How our investment profiles change as you approach retirement

Our three investment profiles – ‘balanced’, ‘cautious’, and ‘adventurous’ – automatically reduce risk from 15 years before your chosen retirement date by gradually switching from higher-risk investments, like shares, into lower-risk investments like cash or bonds.

Alternatively, you can choose from our eight funds. These don’t adjust automatically, so you’ll need to manage them yourself. If you choose this option, we recommend seeking pension investment advice from a financial adviser, who may charge for their services.

FAQs

For more information, see our help and support section.

How are workplace pensions invested?

When you pay into a workplace pension, your money’s invested in a pension fund. Instead of selecting individual investments on your own, a fund offers a diversified mix all in one package, making it easier to manage your savings and spread risk. Traditional investments within a fund include stocks, shares and cash, but increasingly, they can also include property and infrastructure.

Can I choose where my money’s invested?

Yes, you can choose from one of three investment profiles or a combination of eight pension funds. However, if you choose the Shariah Fund, you’ll need to invest all your pension savings with us in this fund

Where can I find fund unit prices?

Our fund prices change daily with the market. Check the latest fund unit prices in the employer section of our website.

Where is the best place to invest my pension?

It depends on your investment goals and attitude to risk.

Pension funds that invest in higher-risk assets like shares offer the potential to generate larger returns, but they can also go up and down in value more often. Lower-risk options, like bonds or cash, tend to be more stable but may grow more slowly.

Many people start with higher-risk investments when retirement is far off, then move to lower-risk funds as they get closer. If you’re unsure, it’s a good idea to speak to a financial adviser.

What’s the annual management charge?

Every workplace pension scheme charges members for looking after their savings. This is known as the annual management charge (AMC). Find out more about our annual management charge and how we reward you as your savings grow.

However, due to the costs incurred, we reserve the right to charge a fee if you switch funds more than twice a year.

Investment funds

Explore our range of pension funds.

Responsible investments

Discover investment options that drive positive change.

Investment resources

Access key documents and insights that support investment decisions.