Taking your pension pot a bit at a time

There are two ways of taking your pension pot a bit at a time as flexible lump sums. As with all of your options, overall you’ll get 25% of your pension pot tax free usually, and the remaining 75% is taxable. But if you’re taking it a bit at a time – you’ll need to decide how you want to take your 25% tax-free cash.

Why would someone choose to take

their money a bit at a time?

These options will work differently for different people, depending on a whole range of circumstances and factors. That’s why we always recommend you get guidance and advice as well as doing your own research. But generally, tax is a major deciding factor when choosing which way you want to take your pension pot.

The income tax you pay is calculated on a yearly basis. So it’s important to consider whether adding the money you take from your pension to your other income for a certain year could push you into a higher tax band. If this happens, it could mean you pay more tax than usual.

By only taking as much money as you need each year, you can plan your pension pot withdrawals so that you stay within a lower tax band, meaning you pay less in tax.

How to take your pension money

When you’ve considered your options and decided how you want to take your pension savings, you can request this quickly in your Online Account.

Two ways to take it a bit at a time with The People's Pension

If you want to take your pension pot gradually with us, you’ll need at least £10,000 in your pot to get you started (or £2,000 if you’ve already taken some money). We offer two ways to do this.

Please remember that money you take now will reduce the value of pension income available in the future.

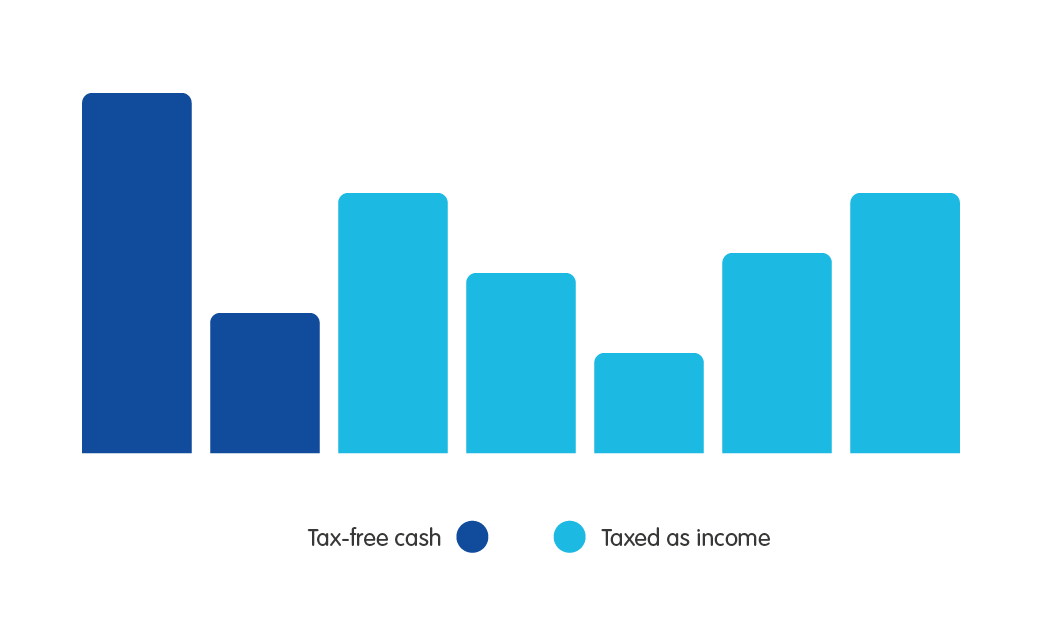

1. Take your tax-free cash up front

The first option is to take your 25% tax-free cash up front either in small chunks or in one go.

This method of taking your pension pot a bit at a time is often called ‘flexi-access drawdown‘.

Suitable if:

- You just want to take some or all of your tax-free cash.

- You don’t want to limit how much can be paid into your pension pot in future.

By taking your tax-free cash in smaller chunks, you’re keeping more of your money invested, so it has a better chance to increase in value, meaning you could get more tax-free cash in later life.

How it works

Under HMRC rules, for every £1 of tax-free cash you take, £3 will be moved to a flexi-access drawdown account that we’ll set up for you. Then, each time you take money out of your flexi-access drawdown account, the value taken will count as income in the year you take it and so you may pay tax on it. Any tax-free cash not taken stays in your pension pot, giving it a chance to grow so you may get more tax-free cash later on.

Find out if taking your tax-free cash up front (flexi-access drawdown) is right for you

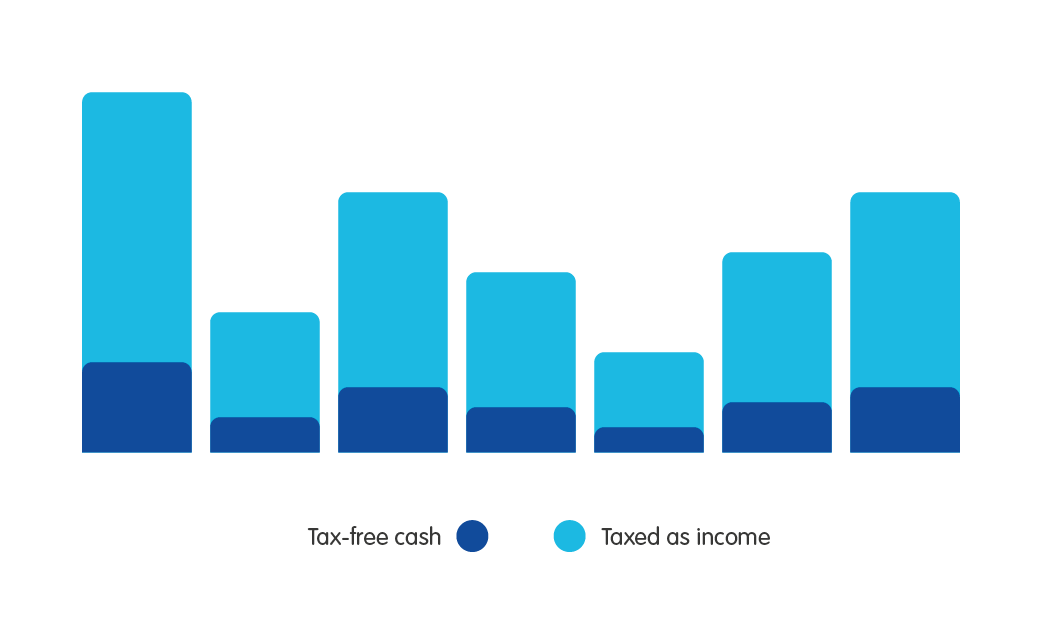

2. Spread your tax-free cash across all withdrawals

The second way you can take your pension pot is to dip into it as and when you need it, spreading your tax-free cash across all withdrawals. It means a part of every payment may be taxed as income. HMRC calls these lump sums ‘uncrystallised funds pension lump sums‘ or ‘UFPLS’.

Suitable if:

- You’re happy to pay tax on your pension withdrawals as you go.

- You understand that 75% of the value withdrawn will be treated as income so you may pay tax on it.

Taking money in this way will limit how much can be paid, by you and your employer, into any of your pension pots in future due to the money purchase annual allowance.

How it works

With this option, each time you take money from your pension pot, 25% of it is usually tax free and you may pay tax on the other 75% of each lump sum.

Different amounts can be taken each time with the remainder of your money staying invested, giving it a chance to grow.

Find out if spreading your tax-free cash across all withdrawals is right for you

Consider combining your pension savings

If you’ve got more than one pension – you might want to think about putting them all in one place so that they’re easier to manage. The amount you have in your pension pot affects which options you can take your money through. So by combining your pension savings into one, you could change the options available to you. It’s also important to compare the charges, features and services between the pension you want to transfer out of and the pension you want to transfer into – to make sure it’s the best option for you. Find out about our charge.

Should you combine your pensions before taking it a bit at a time?

If you want to take your pension pot a bit at a time with The People’s Pension, you need to have more than £10,000 in your pot to get you started. So if you have less than £10,000 in your pension pot with us at the moment, you might be able to get your pot above this figure by transferring your pensions into your pot with us. And that would mean the option of taking your pension pot a bit at a time would become available to you. It’s also important to compare the charges, features and services between the pension you want to transfer out of and the pension you want to transfer into – to make sure it’s the best option for you. Find out about our charge.

Combining your pension savings with

The People's Pension

You could transfer your other pensions into The People’s Pension. It’ll be easier to keep track of them in one place and you could save money on charges too. If you’re unsure what’s right for you, it’s a good idea to consider getting advice. Otherwise, if you’re comfortable making financial decisions, all you need to do is give us the details of your other pensions (either online or by post) and we’ll do the rest.

What’s the difference?

Does The People's Pension offer this option?

Will I pay tax on the money I receive?

Will this option affect my tax relief if I want to continue saving into a pension?

Is the money guaranteed to last for the rest of my life?

Do I have any other choices, once I have selected this option?

Can I leave money to someone when I die through this option?

What are the risks?

How do I choose this option with The People's Pension?

| All your options at retirement | Keep your money where it is | Take it all in one go | Take it a bit at a time | Buy a guaranteed income or 'annuity' |