Over

7 million*

members save with us

£100m

paid back*

into members’ pots

More than

£39bn assets*

under management

We’ll make this easy for you

As the UK’s largest commercial master trust, we focus on simplicity and putting people first. Whether you’re working with one client or a hundred, we’ve got the tools and support to make your life simple.

Free means free

If you’re helping a client set up a scheme with us there’s no charge and no ongoing fees.

Use our Adviser Centre

To sign up clients, access your full toolkit, download key resources, and share your reduced charge code with ease.

Need help?

Our award-winning UK-based team is here for you, with expert support from 8.30am to 6pm, Monday to Friday (excluding bank holidays).

Big on pensions. Bold on purpose.

With more than £39bn assets under management, we invest our members’ money with one clear goal – to help their pension grow steadily and securely over time, so they can enjoy a better retirement.

Our scheme is built to reflect our members’ needs and values:

Growth on members’ terms

Flexible investment options that are easy to understand and aligned with different life stages.

Strong commitment to sustainability

We now invest 80% of our members’ money into climate-aware investments, having moved an initial £15bn in 2024 – the largest shift into green investments of any UK master trust pension scheme. We make responsible investment decisions considering environmental, social, and governance (ESG) factors.

Empowering financial futures

Our best price guarantee ensures members re-joining through another employer can combine their pots at the lowest charge. And our financial wellbeing tool offers simple guidance and resources to help savers take control of their finances

A pension that works hard for their future and stands up for their values.

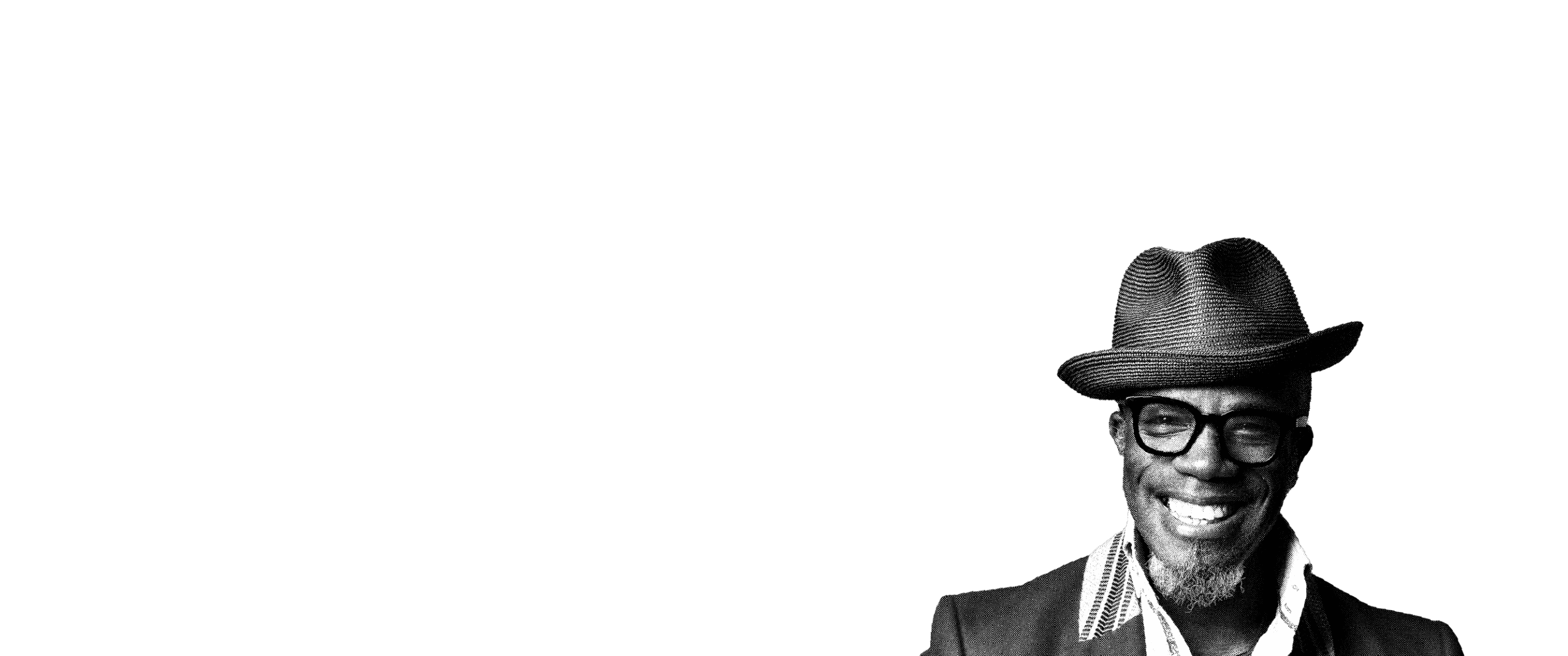

Have your people call our people

Our workplace engagement team offers hands-on, expert guidance to support your clients – giving them the tools to understand, manage, and make the most of their pension.

Payroll integration

Clients can streamline pension processes by linking payroll software directly to People’s Pension, saving time, reducing errors, and making contributions simpler.

Free communications toolkit

Ready-to-use emails, posters, and guides make workplace pension communications a simple and effective way to boost engagement for employers.

Tailored microsites

Employers can give their people easy access to everything they need to understand and manage their pension — all in one branded, easy-to-use microsite.

What our customers say

Debra Hayes | Rentokil

Ready to offer a pension with impact?

We’re committed to meeting the financial needs of today’s workforce, ensuring everyone is prepared for the future. Whether it’s for a large employer or a single member, we aim to make setting up with People’s Pension as easy as possible.

Trusted by advisers and employers alike

*All figures correct as of 31 December 2025