What are the National Insurance changes in April 2025?

As of April 2025, there is a rise of National Insurance (NI) contributions for employers from 13.8% to 15%. Additionally, the threshold for when employers begin paying NI drops from £9,100 to £5,000 per employee each year.

How will the National Insurance changes affect employers’ costs?

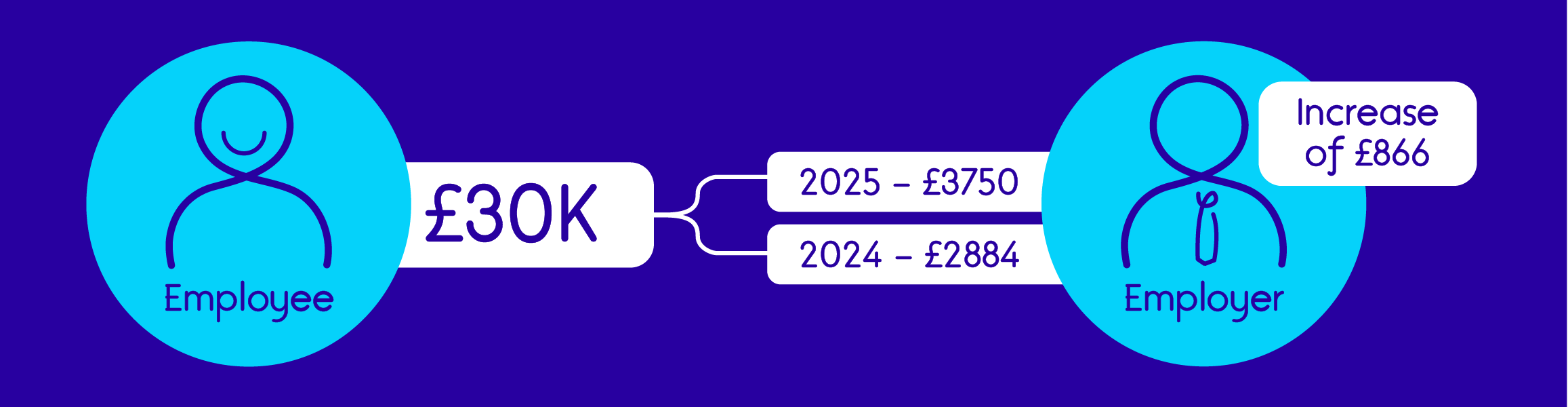

Let’s say you have an employee who makes £30,000 a year. With the new NI rates, you’d have to pay about £866 more each year. In total, this would be a payment of £3,750, up from £2,884 before the increase.

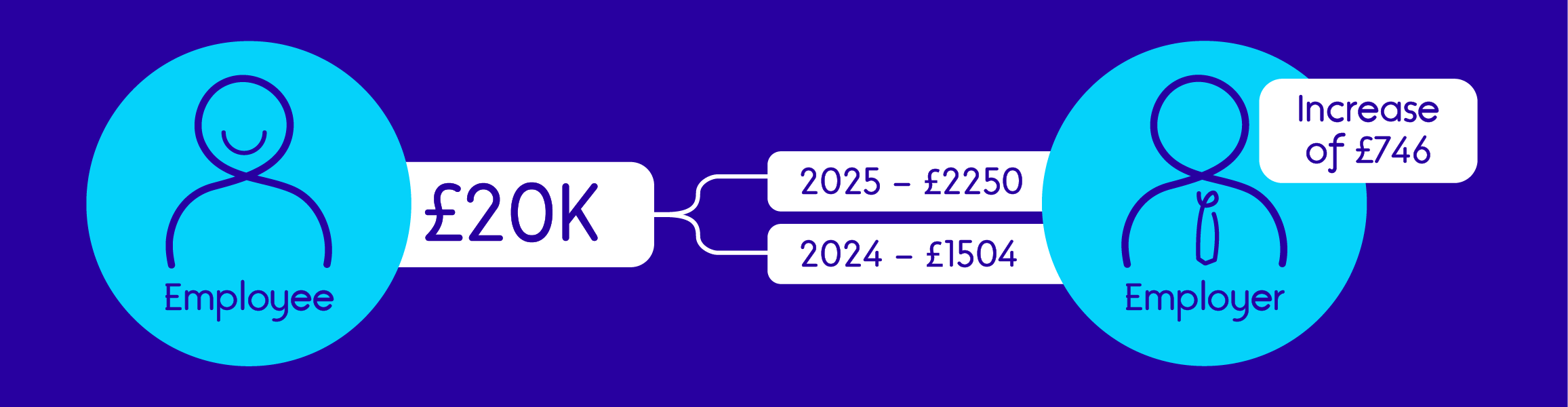

These changes also affect workers on minimum wage. For instance, if you have a minimum wage worker who earns £20,000 a year, the increased NI contribution could mean an extra £746 for you as the employer. As employer costs rise, businesses might need to rethink their budgets and could end up passing some of these costs onto employees or changing their hiring plans.

In short, the changes to NI contributions could impact salaries and make it harder for employers to manage costs, especially for those earning less.

Why are the changes happening?

The recent NI changes aim to tackle rising costs and fund vital public services, especially the NHS and social care. With pressures from global events, the Labour government is seeking extra revenue to ensure these services are economically sustainable. In particular, they’re trying to raise money without increasing taxes on employee income.

What is the new National Insurance threshold for 2025?

From April 2025, the NI threshold is £5,000 per employee each year.

What is the percentage National Insurance Contributions increase?

A rise in NI contributions from 13.8% to 15%, which is an increase of 1.2%.

Does salary sacrifice affect National Insurance?

When an employee opts for salary sacrifice, they agree to give up a portion of their salary in exchange for non-cash benefits, which can lower taxable income. This in turn can reduce NI contributions.

There are several types of salary sacrifice, such as for nursery care or electric vehicles, or for increased pension contributions. Sacrificing part of an employee’s salary for pension contributions can be a smart move, as it not only boosts the employee’s retirement savings but also lowers the employer’s NI bill.

Overall, different types of salary sacrifice arrangements can help employers manage their finances more effectively while providing valuable benefits for their workforce.

Pension salary sacrifice and your business’ National Insurance costs

Essentially, when an employee agrees to give up a portion of their salary in exchange for non-cash benefits, it reduces the amount of salary that is subject to NI contributions.

For example, let’s say your employee earns £30,000 and puts 5% (£1,500) into their pension, and you the employer add 3% (£900). Your pension contributions don’t incur NI contributions, so you don’t save on NI contributions for these pension contributions.

If your employee gives up an extra £3,000 of their salary to increase their pension, their taxable salary becomes £27,000. This lower salary means both you and your employee would pay less in NI contributions. You’d save £450 in NI contributions (15% of £3000).

In short, your employee benefits from increased pension savings, while you also lower your NI contributions costs on the £3,000 paid into the pension.

How we can help you save more

If you want to know more, get in touch with your dedicated Relationship Manager. They’ll chat about how salary sacrifice could work for your business and explore your options together. You can also visit the page on salary sacrifice on the government’s website for more information.

1 in 5 savers have never checked their pension

Our research on the challenges of pension engagement.

Boost financial wellbeing

Discover how getting your team’s financial wellbeing in shape can help your business.

Communications toolkit

Use our emails, videos, and free resources to explain pensions to your staff.

We’re always happy to help

We can support your wider workplace engagement plans, and if you’re an adviser, we can manage your clients’ account

Adviser – Contact us Employer – Contact us