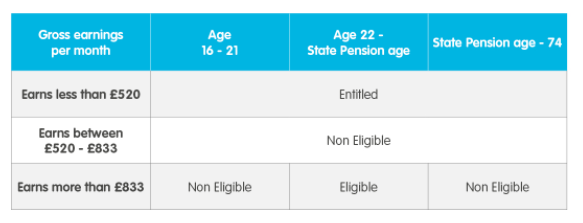

Your employees are given an auto-enrolment status based on their age and earnings. The majority of your employees (that ordinarily work in the UK) will be either Eligible, Entitled or Non Eligible.

Eligible

Use this status if an employee:

- earns over £192 per week (equal to about £833 a month or £10,000 a year)

- is aged between 22 and State Pension age

- ordinarily works in the UK.

You must put these employees into a pension scheme and regularly pay into their pension pots. The Pensions Regulator (TPR) sometimes refers to this as ‘type 1’ employees.

Non Eligible

Use this status if an employee:

- is aged between 16 and 21 or between State Pension age and 74

- earns over £192 per week (equal to about £833 a month or £10,000 a year)

- ordinarily works in the UK.

Or

- is aged between 16 and 74

- earns between the lower earnings threshold (£6,240 a year) and £10,000 a year

- ordinarily works in the UK.

A Non Eligible jobholder doesn’t have to be auto-enrolled into a workplace pension. They can ask to opt in to an employer’s pension scheme, and their employer will have to pay into their pension pots on a regular basis. TPR sometimes refers to this as ‘type 2’ employees. Read more about assessing an employee as Non Eligible on our website.

Entitled

Use this status if the employee:

- is aged between 16 and 74

- has earnings less than the lower earnings threshold (currently £6,240 a year / £520 a month / £120 a week)

- ordinarily works in the UK

An Entitled worker doesn’t need to be auto-enrolled. They can ask to join an employer’s pension scheme, but the employer doesn’t need to pay money into their pension pots unless they’d like to. Read more about assessing an employee as Entitled on our website.

What other statuses do we accept?

Contractual Enrolment

This is when employers put all of their employees into a pension scheme, without working out which employees they need to auto-enrol.

Each employee must agree to join the pension scheme and have contributions deducted from their salary, if applicable. This consent is given when they accept the terms set out in their employment contract.

Read more in our guide to contractual enrolment.

Not Known

- if you’ve chosen The People’s Pension to assess the eligibility criteria of an employee (new starter or in postponement period) on your behalf and the employee’s status hasn’t been confirmed yet, or

- if an employee doesn’t have a pension but does have Employee Life Cover/Employee Accident Cover with B&CE.

Not Applicable

Use when an employee is aged under 16 or over 75. This is because auto-enrolment doesn’t apply to them due to their age.

Already in qualifying scheme

Use when an employee has a pension elsewhere, in a pension scheme that is already a qualifying workplace pension scheme for auto-enrolment.. We don’t accept pension contributions for employees already in a qualifying scheme.

More…

Understand how to work out what your employee’s auto-enrolment status is on our website.