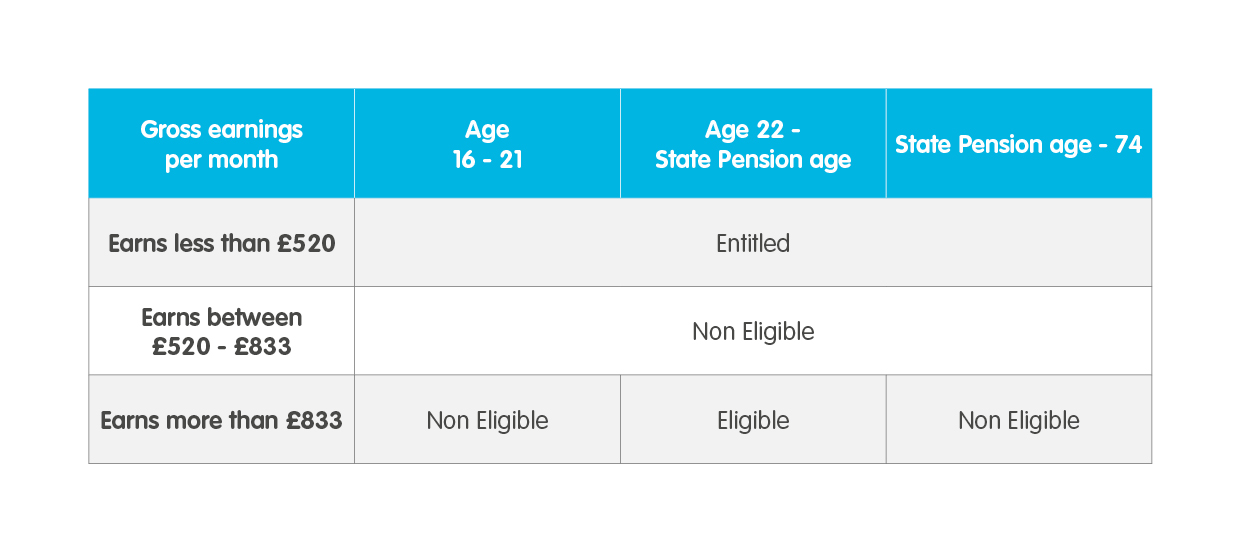

The auto-enrolment status of your employee is dependant on both their age and earnings when you assess them:

When you submit a data file to us, we check their age according to the end date for that pay period.

When should an employee be auto-enrolled?

You can upload your employee data for an Eligible employee if they’re aged between 22 and under State Pension age by the pay period end date of the file you’re uploading. There are a number of different times you’ll need to assess your employees’ eligibility – The Pensions Regulator has lots of information to help with this.

Only Eligible employees need to be automatically enrolled into a pension scheme, but all employees aged 16-74 have the right to opt in or join a pension scheme. To make sure these employees understand their rights to opt in or join the pension scheme, you should write to them:

- when you reach your duties start date, or

- when a new starter begins with your company, or

- when an employee turns 16 years old.

Our template letters can be used for this:

- Template letter – to let entitled/non-eligible employees know how to join or opt in to The People’s Pension

- Template letter – to tell your employees you’re using postponement

What happens if a Non Eligible or Entitled employee wants to join the pension scheme?

Non Eligible jobholders: Require their employer to arrange for them to become an active member of a pension scheme by giving their employer an ‘opt-in notice’. If your employee asks to opt in, you’ll need to contribute to their pension at the minimum contribution level (but you can choose to pay more if you’d like).

Entitled workers: Require the employer to arrange for them to become an active member by giving the employer a ‘joining notice’. If your employee asks to join a pension scheme, you won’t need to contribute to their pension, but can choose to do so if you’d like.

What is an opt-in or joining notice?

It records that the employee requested to join the pension scheme. It’s important that employees assessed as Non Eligible jobholders and Entitled workers send you a valid notice before you add them to the pension scheme.

Both an opt-in or joining notice must be:

- in writing – but doesn’t have to be a formal document. It can be a letter or an email

- signed by the employee submitting it. If it was sent by email, it must include a statement from the employee confirming that they personally submitted the notice.

TPR states opt-in and joining notices must be kept by the employer in their original form for 6 years.

During a file upload, you may see an error explaining the auto-enrolment status of your employee isn’t correct. To solve this, you should check both your payroll and the data file you’re uploading to make sure they contain:

- the correct date of birth

- the correct auto-enrolment status.

Then amend your data file or payroll settings and re-submit your data file to us.