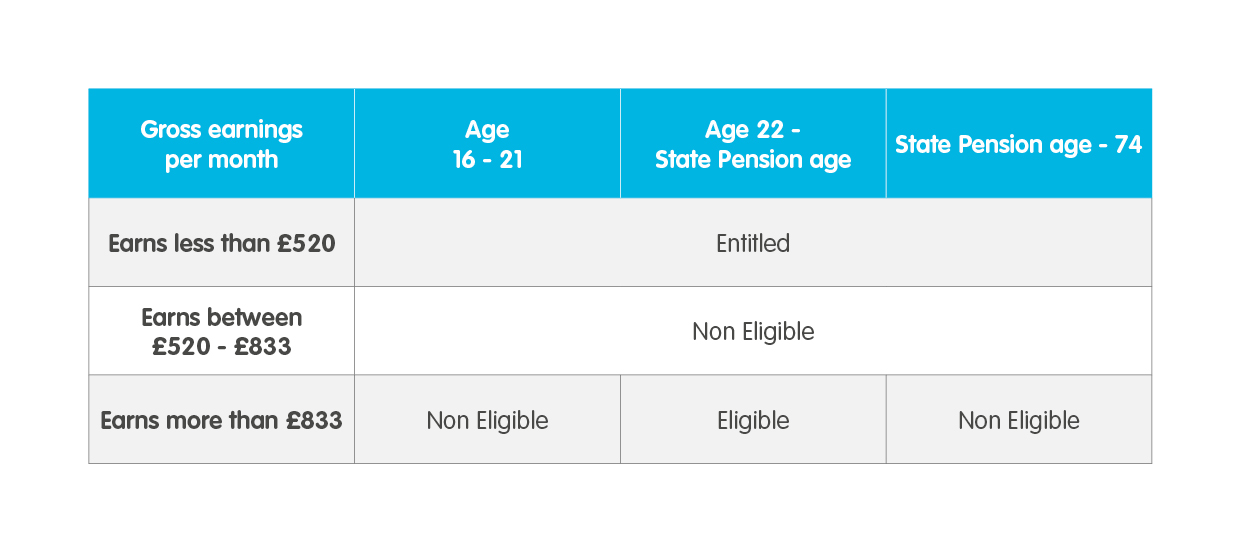

The auto-enrolment status for an employee under 22 is either Entitled or Non Eligible, depending on their earnings. Someone under 22 shouldn’t be auto-enrolled, and so wouldn’t have an Eligible status.

If your employee is enrolled in the pension scheme with an Entitled status:

- They cannot have an Eligible status until they reach 22 and have earnings greater than £833 per month.

- They can become Non Eligible if their earnings increase. You should then begin making pension contributions for them at the minimum contribution levels (if you weren’t already).

If your employee is enrolled in the pension scheme with a Non Eligible status:

- They cannot have an Eligible status until they reach 22 and have earnings greater than £833 per month.

- They cannot become Entitled, so even if their earnings drop below £520 per month. You must continue to provide pension contributions for them.

But if the employee stops active membership and then asks to join again (or leaves and then returns to your employment), they should be reassessed based on their age and earnings.

Errors during file upload

During file upload, you may see an error explaining the auto-enrolment status of your employee isn’t correct. To solve this, you should check both your payroll and the data file you’re uploading to us to make sure they contain:

- the correct date of birth

- the correct auto-enrolment status.

Then amend your data file or payroll settings and then re-submit your data file to us.