These are the earnings your pension contributions are usually based on if you contribute to a pension scheme.

They include your:

- salary

- wages

- overtime

- bonuses and commission

- statutory sick pay

- any statutory pay received during paternity, maternity, adoption or any other kind of family leave.

Some employers use a different earnings basis though – usually either pensionable earnings or total earnings.

So how much do you contribute to your pension?

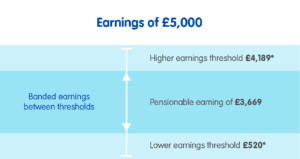

However much of your qualifying earnings come between £6,240 and £50,270, that’s what the contributions you and your employer make will be calculated from. (Those are the figures for the current tax year – they’re reviewed every year by the government.) Qualifying earnings would be based on the amount between the upper and lower-level earning thresholds. You might also see this called ‘banded earnings’.

Annual earnings example

Say you earn £25,000. £25,000 minus £6,240 leaves £18,760. So your contributions will then be calculated from £18,760 – either at the minimum percentages set by the government, or your employer can set higher percentages if they want to.

Monthly earnings example

If your employee’s monthly earnings are £5,000, the lower earnings threshold of £520 (*for the current tax year) is deducted and any earnings over the upper earnings threshold of £4,189 are ignored. So, for this example the pensionable earnings on which pension contributions should be based is £3,669.

What if your employee’s monthly earnings are below the upper earnings threshold?

If for example, you earned £3,000 a month instead, only the lower earnings threshold of £520 would be deducted from your monthly earnings. This is because your earnings are below the upper earnings threshold. For this example, the earnings on which pension contributions should be based is £2,480.

More…

For more information, take a look at The Pensons Regulator’s website.