The earnings used to calculate a member’s pension contributions are known as their ‘pensionable earnings’. They may include:

- basic salary

- overtime

- bonuses

- commission

- statutory payments such as maternity and paternity or sick pay.

You might also see this referred to as ‘pensionable salary’.

What are the pensionable earnings when the qualifying earnings basis is used?

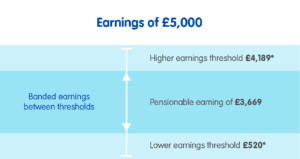

If an employer has chosen to use the qualifying earnings basis to work out pension contributions, the pensionable earnings is based on the amount between the upper and lower level earning thresholds. You might also see this called ‘banded earnings’.

For example, if an employee’s monthly earnings are £5,000, the lower earnings threshold of £520 (*for the tax year) is deducted and any earnings over the upper earnings threshold of £4,189 are ignored. So, for this example the pensionable earnings on which pension contributions should be based is £3,669.

*current tax year

What if the employee’s monthly earnings are below the upper earnings threshold?

If for example, an employee earned £3,000 a month instead, only the lower earnings threshold of £520 would be ignored from their monthly earnings. This is because their earnings are below the upper earnings threshold. For this example, the earnings on which pension contributions should be based is £2,480.

What are the pensionable earnings when the pensionable earnings basis is used?

If an employer uses the pensionable earnings basis to work out members pension contributions, the earnings thresholds don’t apply. Pension contributions are based on earnings that normally include salary or wages, but may exclude variable amounts such as commissions, bonuses and overtime. At a minimum this should include basic pay unless the employer has chosen to base calculations on total earnings. If total earnings are used, all elements of pay should be included in pension contribution calculations.

What are the pensionable earnings when the total earnings basis is used?

If an employer has chosen to use total earnings basis to work out pension contributions, all elements of pay should be included.

For more information, take a look at The Pensions Regulator’s website.

More…

Read more about earnings basis»