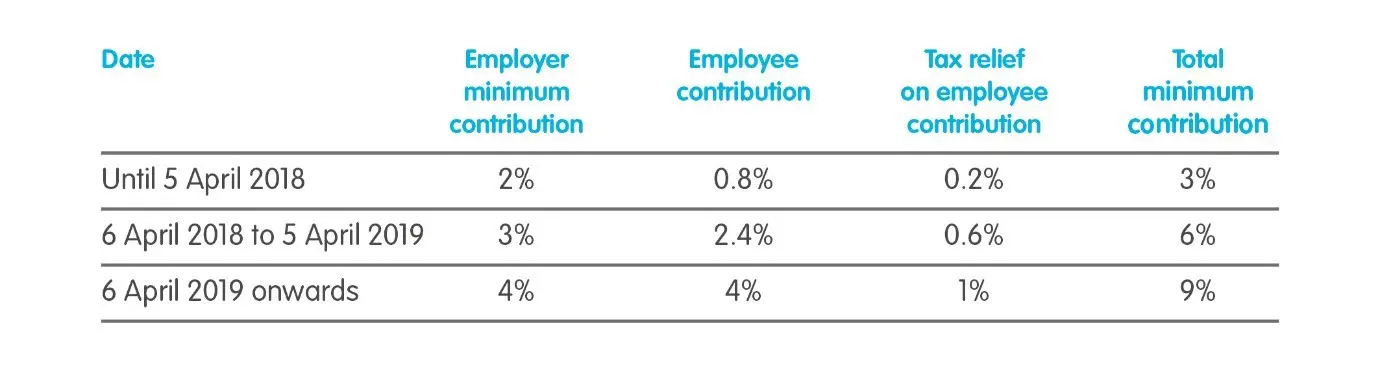

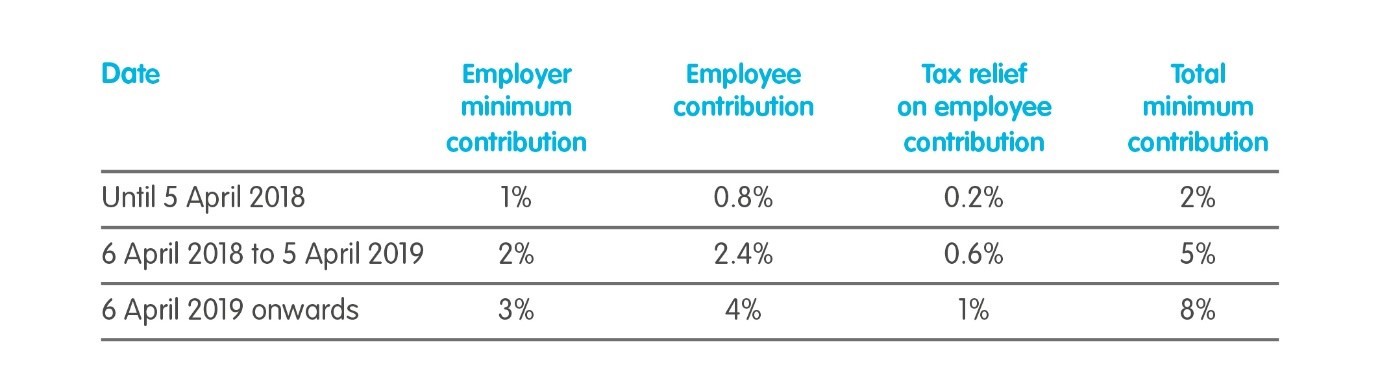

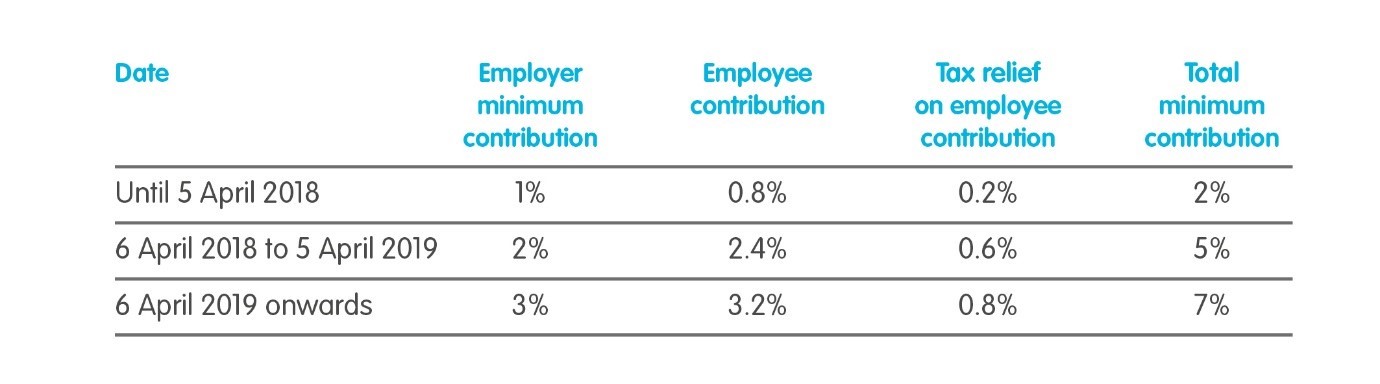

When an employer has decided to use their own definition of pensionable pay (also known as self-certification), there are different minimum contribution levels. Employers should confirm which definition of pensionable pay they’re using and check which minimum contribution level applies to them.

If an earnings basis other than qualifying earnings is selected, self-certification is required at least every 18 months to confirm that the chosen basis meets the minimum requirements. You can find a template for this on the government’s website (Annexe E).

These tables are based on the relief at source method of claiming tax relief. Read more about tax relief on our website.

Set 1: pensionable earnings (basic) – worked out using at least basic pay. Contributions from first £1 earned – no thresholds.

Set 2: pensionable earnings (85%) – worked out using at least basic pay. When combining all employees using this set (including all employees you’re certifying for), the average basic pay must always make up at least 85% of the average total pay. Contributions from first £1 earned – no thresholds.

Set 3: total earnings – worked out using everything an employee is paid. Basic pay, plus all other earnings. Contributions from first £1 earned – no thresholds.