The pay period (PRP) is the time between regular wages or salary. You might also see it called a pay/payroll frequency, payroll period, or payroll schedule. They’re usually either weekly, monthly, 4-weekly or fortnightly. Employers can choose to align these to tax weeks or months.

The pay period relates to the amount of time the employee is paid for, rather than the amount of time between payments (pay frequency). If an employee is paid weekly on a Wednesday for hours completed between Sunday and Saturday the previous week, the pay period is from Sunday to Saturday, not Sunday to Wednesday or Wednesday to Wednesday. The pay period should include the day the employee is being paid.

Examples of a pay period

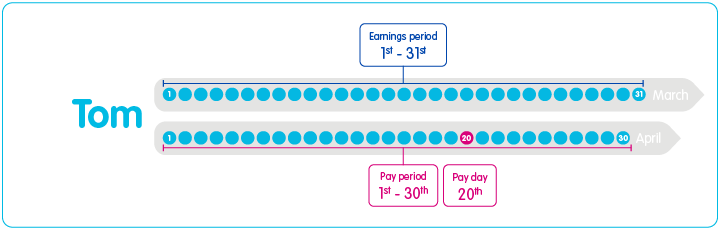

Tom is paid a monthly salary in arrears, regardless of how many hours he works in the month. He’s paid on the 20th of April for work done from the 1st to the end of the previous month (March). Tom’s pay period runs from the 1st to the end of the month in which he is paid (1 – 30 April).

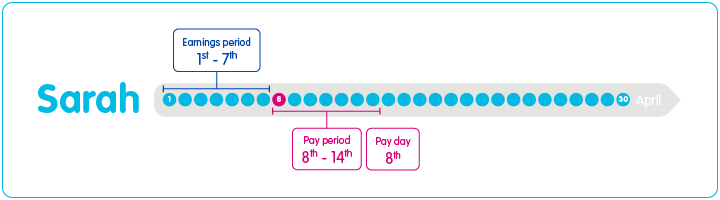

Sarah is paid a weekly salary and works 1-7 of April but is paid in arrears on the 8th of April for the work she carried out. Her earnings period is 1-7 April, but her pay period is 8- 14 April.

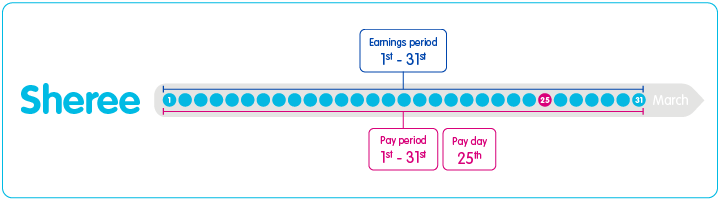

Sheree is paid weekly on March 25 for the hours worked from March 1 – March 31. His earnings period and pay period is from March 1 – 31.

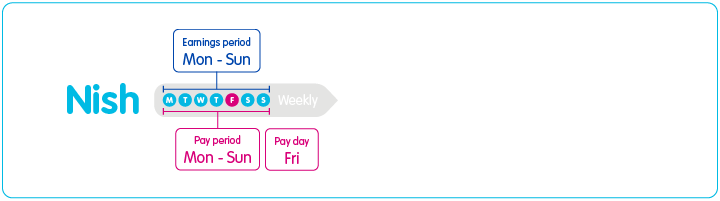

Nish is paid weekly on a Friday for the hours worked during the week, beginning on a Monday and ending on the Sunday. His earnings period and pay period is from Monday – Sunday.