Both flexi-access drawdown (FAD) and uncrystallised funds pension lump sum (UFPLS) are ways of taking your pension pot a bit at a time. The main difference is when you take your tax-free cash.

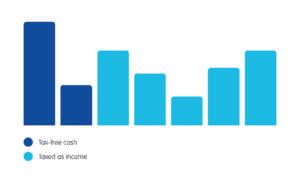

Taking your tax-free cash up front – flexi-access drawdown

Using flexi-access drawdown you take 25% tax-free cash up front either a bit at a time or in one go. Under HMRC rules, for every £1 you take as tax-free cash, £3 moves to a flexi-access drawdown account.

Then, each time you take money out of your flexi-access drawdown account, you may pay tax on the full amount of each lump sum. Once you start taking money from your flexi-access drawdown account your money purchase annual allowance (MPAA) is triggered. At any time, you can choose to use any remaining money in your flexi-access drawdown account to buy an annuity, or transfer it to another flexi-access drawdown provider.

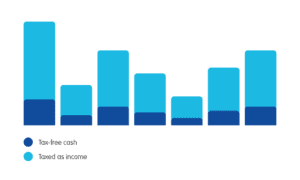

Spreading your tax-free cash across all withdrawals – UFPLS (uncrystallised funds pension lump sum)

The second way to take your pension pot a bit at a time is to spread your tax-free cash across all withdrawals.

So each time you take money from your pension pot, 25% of it is tax-free and you may pay tax on the other 75% of each lump sum. When taking your pension savings in this way your money purchase annual allowance (MPAA) is triggered the first time you make a withdrawal. At any time you can choose to take a different retirement option with any remaining money in your pension pot or transfer it to another provider.

Making a decision

These options will work differently for different people, depending on a whole range of circumstances and factors. We can’t tell you which option is best for you. That’s why we always recommend you get guidance and advice as well as doing your own research.

To find out more about each of these options, take a look at our webpage about taking your pension savings a bit at a time.

When you’ve decided and you’re ready, find out how to take your pension money.