Leading not-for-profit workplace pensions provider to cut fees as it returns profits to members, saving them thousands more across their lifetime

The People’s Pension1, a leading, not-for-profit workplace pension provider, has today revealed plans to return profits to members by cutting fees, potentially saving people thousands more towards their retirement.

With auto-enrolment maturing, pension pots growing, and contributions set to rise further to eight per cent from April this year, the rapidly growing master trust will this summer move from its already low-cost AMC of 0.5 per cent to a banded pricing structure. Member charges as a percentage, will fall as their pension pots grow, giving them a long-term incentive to stick with auto-enrolment saving and to consolidate multiple pots.

The new pricing structure immediately reduces the fee revenue which The People’s Pension receives from its membership’s Annual Management Charges (AMC) by 10 per cent.

An average earner saving over their working life with The People’s Pension could see their lifetime AMC fall by more than half to just 0.23%2, potentially increasing their pension pot at retirement by:

- almost £55 000 when compared to a lifetime fee set at the charge cap of 0.75% – nearly five years additional retirement income3

- almost £30 000 when compared to a lifetime fee set at the already low 0.50% which members of The People’s Pension currently pay – nearly three years additional retirement income4

A member’s AMC will reduce as their savings increase through the following bands5, with the charge they pay shown simply and transparently in pounds and pence each month in their online account.

Commenting on this announcement, Patrick Heath-Lay, CEO of B&CE, provider of The People’s Pension, said:

“Auto-enrolment is on the cusp of a significant landmark, with contributions set to rise for 10 million savers across the UK. Providers need to respond imaginatively to ensure auto-enrolment is attractive over the long-term, rewards people for saving and incentivises the consolidation of multiple pots.

“Charges can eat away at pensions, and on a flat-rate, percentage fee savers pay a lot more in pounds and pence the more they save. We’re reducing members annual charges as a percentage of their savings in line with the growth of their pot, potentially boosting their retirement income by thousands.

“The People’s Pension led the auto-enrolment market by offering all employers, whether large or small, the same uniform single charging structure for their employees, removing a sense of unfairness in industry charging practices. We’re taking this approach further by offering all members the same clear incentive to save for the long-term. We urge the industry to follow suit.”

ENDS

Notes to Editors

- The People’s Pension is a leading, not-for-profit master trust (multi-employer pension scheme), provided by B&CE. Since its creation in 2012 it has grown to serve more than 4 million members and more than 85,000 employers across the UK. Assets under management are £5.7bn. Accurate at 21 February 2019. We tweet as @peoplespension.

- All modelling assumes:

- earnings £30,000 per annum (UK media fulltime annualised wage £29,588, ONS 2018)

- timeframe 45 years

- contributions at 8% of qualifying earnings

- investment returns 5% per annum

- inflation 2.5% per annum

Earnings: £10,000 per annum

| Year | TPP New Charges | TPP New Fund value | TPP New average lifetime AMC | TPP Old Charges | TPP Old Fund value | 0.75% Charges | 0.75% Fund value |

| 5 | £21.83 | £1,852.18 | 0.5% | £21.83 | £1,852.18 | £32.61 | £1,840.49 |

| 10 | £95.90 | £4,379.30 | 0.5% | £97.54 | £4,377.60 | £145.04 | £4,321.67 |

| 15 | £230.66 | £7,827.98 | 0.47% | £247.03 | £7,809.49 | £365.62 | £7,658.06 |

| 20 | £442.77 | £12,476.47 | 0.45% | £496.09 | £12,411.64 | £730.64 | £12,087.07 |

| 25 | £738.57 | £18,698.27 | 0.42% | £877.93 | £18,518.95 | £1,286.35 | £17,906.88 |

| 30 | £1,141.62 | £26,958.98 | 0.40% | £1,435.18 | £26,555.94 | £2,091.53 | £25,491.36 |

| 35 | £1,670.03 | £37,867.64 | 0.37% | £2,222.42 | £37,059.98 | £3,220.68 | £35,308.70 |

| 40 | £2,354.60 | £52,199.25 | 0.35% | £3,309.36 | £50,710.52 | £4,767.90 | £47,944.40 |

| 45 | £3,217.18 | £70,965.01 | 0.33% | £4,784.79 | £68,365.76 | £6,851.87 | £64,129.98 |

Earnings: £23,000 per annum

| Year | TPP New Charges | TPP New Fund value | TPP New average lifetime AMC | TPP Old Charges | TPP Old Fund value | 0.75% Charges | 0.75% Fund value |

| 5 | £88.10 | £8, 084.63 | 0.47% | £95.21 | £8,077.19 | £142.21 | £8,026.20 |

| 10 | £350.67 | £19,174.03 | 0.42% | £425.34 | £19,090.32 | £632.50 | £18,846.41 |

| 15 | £803.21 | £34,385.93 | 0.37% | £1,077.28 | £34,056.46 | £1,594.44 | £33,396.09 |

| 20 | £1,479.65 | £55,007.37 | 0.34% | £2,163.42 | £54,126.04 | £3,186.24 | £52,710.63 |

| 25 | £2,411.75 | £82,712.31 | 0.31% | £3,828.57 | £80,759.49 | £5,609.64 | £78,090.29 |

| 30 | £3,664.23 | £119,637.11 | 0.29% | £6,258.68 | £115,808.07 | £9,120.99 | £111,165.55 |

| 35 | £5,342.13 | £168,503.30 | 0.27% | £9,691.78 | £161,615.23 | £14,045.09 | £153,978.05 |

| 40 | £7,581.27 | £232,798.66 | 0.26% | £14,431.82 | £221,144.01 | £20,792.40 | £209.081.23 |

| 45 | £10,556.99 | £316,988.62 | 0.24% | £20,866.02 | £298,136.94 | £29,880.41 | £279,665.07 |

Earnings: £30,000 per annum

| Year | TPP New Charges | TPP New Fund value | TPP New average lifetime AMC | TPP Old Charges | TPP Old Fund value | 0.75% Charges | 0.75% Fund value |

| 5 | £120.32 | £11,444.33 | 0.45% | £134.72 | £11,429.11 | £201.23 | £11,356.96 |

| 10 | £466.33 | £27,165.72 | 0.39% | £601.85 | £27,012.55 | £894.98 | £26,667.42 |

| 15 | £1,059.14 | £48,753.62 | 0.35% | £1,524.34 | £48,189.45 | £2,256.11 | £47,255.04 |

| 20 | £1,935.82 | £78,050.20 | 0.31% | £3,061.21 | £76,587.64 | £4,508.49 | £74,584.85 |

| 25 | £3,152.93 | £117,428.82 | 0.29% | £5,417.38 | £114,273.63 | £7,937.57 | £110,496.75 |

| 30 | £4,825.37 | £169,901.18 | 0.27% | £8,855.95 | £163,866.90 | £12,906.08 | £157,297.80 |

| 35 | £7,102.29 | £239,331.13 | 0.25% | £13,713.74 | £228,683.44 | £19,873.62 | £217,876.93 |

| 40 | £10,176.59 | £330,670.29 | 0.24% | £20,420.83 | £312,915.89 | £29,420.97 | £295,847.21 |

| 45 | £14,297.21 | £450,258.02 | 0.23% | £29,525.15 | £421,859.88 | £42,280.39 | £395,722.42 |

Earnings: £45,000 per annum

| Year | TPP New Charges | TPP New Fund value | TPP New average lifetime AMC | TPP Old Charges | TPP Old Fund value | 0.75% Charges | 0.75% Fund value |

| 5 | £180.69 | £18,652.83 | 0.42% | £219.38 | £18,611.81 | £327.69 | £18,494.32 |

| 10 | £688.08 | £44,321.46 | 0.35% | £980.09 | £43,988.76 | £1,457.44 | £43,426.74 |

| 15 | £1,546.78 | £79,619.06 | 0.31% | £2,482.32 | £78,474.42 | £3,673.98 | £76,952.77 |

| 20 | £2,819.28 | £127,567.15 | 0.28% | £4,985.05 | £124,719.63 | £7,341.88 | £121,458.18 |

| 25 | £4,648.70 | £191,998.52 | 0.26% | £8,821.97 | £186,089.63 | £12,925.98 | £179,939.15 |

| 30 | £7,223.06 | £277,835.03 | 0.25% | £14,421.53 | £266,850.13 | £21,016.99 | £256,152.63 |

| 35 | £10,786.14 | £391,391.12 | 0.23% | £22,332.24 | £372,401.03 | £32,363.33 | £354,803.11 |

| 40 | £15,653.27 | £540,758.69 | 0.23% | £33,254.44 | £509,569.92 | £47,910.77 | £481,774.31 |

| 45 | £22,231.36 | £736,297.16 | 0.22% | £48,080.42 | £686,980.47 | £68,851.78 | £644,416.76 |

- For the average earner the new charge structure could enable them to save an extra £54,535.60 compared to paying a flat rate AMC of 0.75%. Assuming the average earner requires 2/3rds of their salary as a retirement income and receives a full state pension of 8,767.20 a year (2019/20 prices), the £54,535.60 equals roughly five years additional retirement income.

- For the average earner the new charge structure could enable them to save an extra £28,398.14 compared to our current flat-rate AMC of 0.5%. Assuming the average earner requires 2/3rds of their salary as a retirement income and receives a full state pension of 8,767.20 a year (2019/20 prices), the £30,000 equals roughly three years additional retirement income.

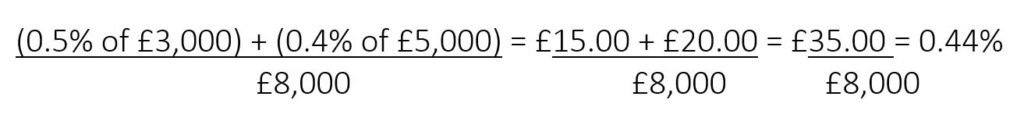

- So for example if a member’s pension pot is worth £8,000, the banded AMC would be calculated as:

Therefore, the monetary charge would be £35.00, and the equivalent AMC would be 0.44%.